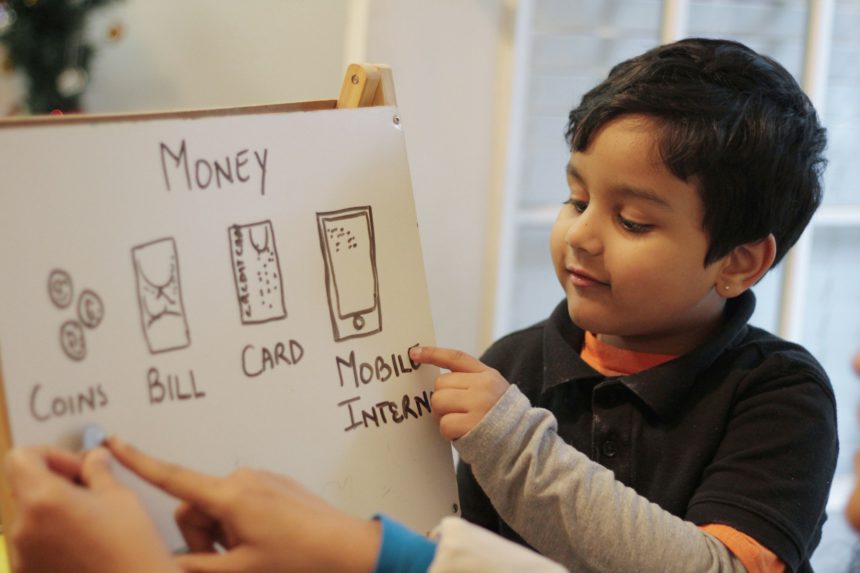

In a world where money and financial resources play an increasingly important role, financial education becomes a need for children. It is essential to teach children to manage money still small so that they can make responsible financial decisions and have a solid foundation for their future. But why is financial education so important in children’s development?

Financial education teaches children to understand basic concepts related to money, such as the value of money, how to save, how to spend responsibly and how to invest. This knowledge will be useful to them throughout their lives, regardless of the field in which they work.

Financial education also helps children develop planning and organizing skills. Learn to set financial targets and find ways to achieve them. In addition, he teaches them thata make wise choices when it comes to spending, so that they are not influenced by impulses or social pressure.

Effective strategies to teach children to save and invest

In order to teach children to save and invest, it is important to use methods and strategies appropriate to their age. Here are some effective ideas to help them develop these skills:

- It starts at a young age: It’s good to start talking to the child about money from a young age. You can explain how money works and give them the opportunity to have their own pocket. Thus, you will teach them to save and understand that money is not available indefinitely.

- Use educational games: There are many games and mobile apps that can help kids learn about money in an interactive and fun wayI mean, I mean, I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… I’m… These games will teach them to make financial choices and understand their consequences.

- Offer them financial responsibilities: Depending on the age of the child, you can give them certain financial responsibilities, such as giving them a sum of money to administer or involve them in the process of purchasing and making financial decisions. Thus, they will develop their money management skills and understand their value.

- Teach them to save: Encourage children to save by setting a financial target, such as buying a toy or a phone. Help them calculate their monthly savings and monitor their progress. Once they reach their goal, you can encourage them to set another one.

- Introduce them into the world of investments: As children grow up, you can learn about investments.You can show them how the economy works and tell them about different ways to invest, such as investments in shares or real estate. It is important to explain the risks and benefits of each form of investment and to help them make informed decisions.

In conclusion, financial education for children is essential for their development and for their financial future. By learning the skills to manage money still small, children will be prepared to make responsible financial choices and have a solid foundation for their future success.